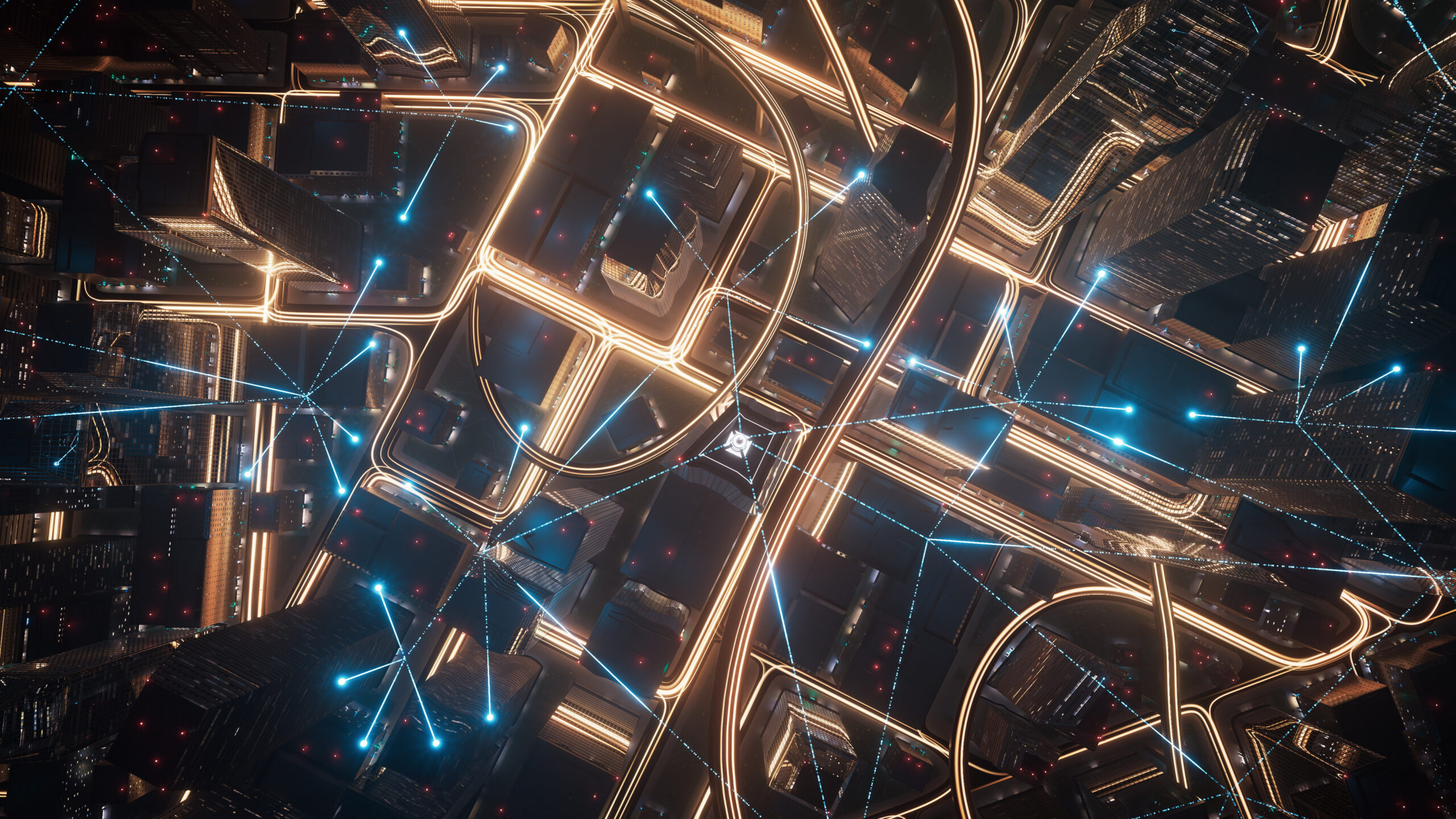

Report Shows Investment in Edge Computing Infrastructure to Grow in 2024

Demand for edge computing infrastructure is growing, according to a groundbreaking new report just released from AECC and GSMA Intelligence. Just as importantly, organizations are mobilizing to meet the demand.

“An impressive 73% of surveyed companies across five industries expressed their intent to increase edge investments over the next 12 months,” said GSMA Intelligence Head of Research Tim Hatt.

The majority of the companies surveyed are planning a 10-15% increase in edge infrastructure budgets in 2024 compared to last year. Another 12% of the companies are even more ambitious, aiming for a surge of 20% or more.

The 400 companies included in the survey include mobile network operators, network equipment vendors, cloud service providers, IoT service providers, and car manufacturers.

The report reveals a wealth of insights into the future of edge and the business landscape that is driving that future.

(Free with registration)

What’s Inside the Report

Here are just a few of the topics covered in the full report. Each section is supported by data from the survey and insights from GSMA Intelligence analysts. For readers less familiar with the subject, the report incorporates background information to provide a robust understanding of the insights presented.

The Evolution of Edge

By 2030, the number of IOT devices is expected to almost double compared Q4 2023 because connected devices are seen as efficiency and/or revenue drivers. But our hunger for more data in our business operations and daily lives often comes with punishing latency and processing burdens. Many industries view edge computing as a big part of the solution.

Competitive Landscape

One of the key questions in the race to monetize the edge is, “who will pay for the infrastructure?” The survey shows that approximately 50% of companies view telco operators as the primary group responsible for investments in edge infrastructure (with two-thirds of operators validating this view themselves). IOT providers and systems integrators are next (43%) followed by equipment vendors (31%).

The landscape in which the edge is developing is complex, however. Fragmentation and a wide diversity along the edge computing value chain means that no single player offers a true end-to-end offering or service. Here, the report explores the different participants in the ecosystem, and how the underlying fragmentation is leading to partnerships, co-opetition, and new business models.

For the automotive industry, demand for a wide range of connected vehicle services such as intelligent driving, mobility as a service (MaaS), and vehicle-to-everything (V2X) offer exciting potential sources of revenue.

Enabling the Edge

Recent technological improvements (like 5G) and emerging innovations (like AI/ML and non-terrestrial networks) are enhancing edge computing capabilities. These capabilities include data processing and analytics, and they are transforming IT and telecom infrastructure.

Outlook

Opportunities are available to a diverse array of providers, and here the report breaks down the planned increase in investment in edge infrastructure and services among MNOs, cloud providers, network equipment vendors, IOT service providers, and car manufacturers. The challenges to overcome are also explored.

The survey findings show that increasing proof of concept development and testing efforts was the top-ranked requirement to scale up edge computing. Boosting the development of compelling edge use cases and strengthening cross-industry collaboration on edge infrastructure were also highly ranked.

Download Your Copy

This report is essential reading for anyone interested in digital infrastructure and how it’s evolving to meet business and societal needs. Be sure to download your copy.